National Minimum Wage (NMW) Compliance Project

About the project

Date:

Jan 30, 2025

Objectives

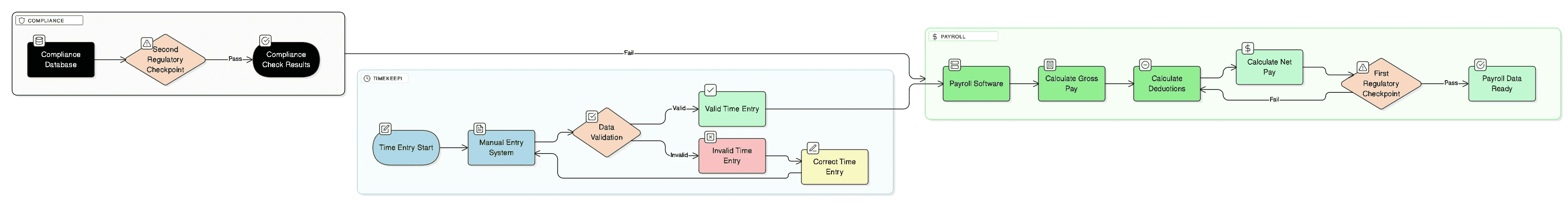

Conduct a full audit of payroll, working time, and deduction records

Identify areas of potential NMW non-compliance

Rectify historical errors and strengthen future controls

Improve accuracy of timekeeping, particularly around unpaid time and uniform deductions

Bianca turned a complex compliance risk into a clear, manageable programme. Her attention to detail and cross-team leadership prevented future issues and strengthened our controls.

Head of Payroll & Compliance

Role & Responsibilities

Led a cross-functional team involving Payroll, HR, Legal, and Finance

Oversaw data extraction, cleansing, and analysis across multiple systems

Built risk matrices and compliance dashboards to highlight potential breaches

Presented findings and remediation recommendations to executive leadership

Coordinated direct employee remediation, policy updates, and future prevention controls

Challenges

Fragmented timekeeping data across legacy systems

Historical manual deductions lacking clear documentation

Identifying hidden or indirect underpayment risks (e.g., pre-shift tasks)

Tight reporting deadlines tied to audit requirements

Solutions Delivered

Conducted detailed pay/time reconciliation for all impacted employees

Created a centralised compliance dashboard with real-time alerts

Implemented new policies for deductions, uniform costs, and timekeeping accuracy

Worked with Payroll and Ops to redesign sign-in/out processes

Delivered training to managers on NMW requirements and audit expectations

Outcomes & Impact

Full visibility of NMW exposure and high-risk employee groups

Eliminated historic underpayment cases and avoided HMRC penalties

Introduced long-term controls, reducing compliance risk for future periods

Improved payroll accuracy and consistency across the organisation